Contact Us

Brown-Phillips Insurance Terms & Conditions

Terms of Service

Effective Date: 02/25/2025

These Terms of Service (“Terms”) govern your access to and use of Brown-Phillips Insurance services (“Services”). By using our Services, you agree to

these Terms. If you do not agree, you must not use our Services.

- Service Overview

Brown-Phillips Insurance provides customer service, sales & support. Use of

our Services is subject to these Terms and all applicable laws. - Eligibility

● To use our Services, you must be at least 18 years old and capable of

forming a binding contract under applicable laws.

● Providing false information during registration or use of Services may

result in termination of your account. - Privacy and Data Usage

● No Sale or Sharing of Data: We value your privacy. We do not sell, rent, or

share your personal data with third parties for marketing or commercial

purposes.

● Your data is only used to provide and improve our Services, as outlined in

our [Privacy Policy]. - Permitted Use

● You may use our Services only for lawful purposes. Prohibited activities

include:

○ Violating any applicable laws or regulations.

○ Misusing the Services to send spam, malware, or engage in

fraudulent activities.

○ Attempting to disrupt or harm our Services or infrastructure. - Fees and Payments

● Use of certain Services may require payment. All fees are outlined during

the registration or subscription process.

● Failure to make timely payments may result in suspension or termination

of access to our Services. - Intellectual Property

● All intellectual property rights related to the Services, including content,

logos, and trademarks, remain the property of Farmers Insurance.

● You may not copy, modify, or distribute any materials provided through

the Services without prior written consent. - Account Suspension and Termination

● We reserve the right to suspend or terminate your account for violating

these Terms or engaging in unlawful behavior.

● Termination may occur without prior notice in cases of severe violations. - Limitation of Liability

● To the maximum extent permitted by law, Brown-Phillips Insurance is

not liable for any indirect, incidental, or consequential damages resulting

from the use of our Services. - Modifications to Terms

● We may update these Terms at any time.

● Continued use of the Services after changes are made constitutes your

acceptance of the updated Terms. - Governing Law

● These Terms are governed by the laws of Wake County, Raleigh, NC.

Any disputes will be resolved exclusively in the courts of Wake County, Raleigh, NC. USA. - Contact Information

For questions about these Terms or our Services, please contact us at:

Email: info@brownphillips.com

Phone: 919-874-0405

By accessing or using our Services, you acknowledge that you have read,

understood, and agree to these Terms.

Brown-Phillips Insurance Privacy Policy

Privacy Policy

Effective Date: 02/25/2025

We DO NOT sell or share your information. Your privacy is important to us, and this Privacy

Policy explains how Brown-Phillips Insurance (“we,” “our,” or “us”) collects, uses, and

protects your information when you use our services (“Services”).

- Information We Collect

We collect the following types of information to provide and improve our Services:

● Personal Information: Information you provide directly, such as your name, email

address, phone number, and payment details.

● Usage Data: Information about your interactions with our Services, including IP

address, device information, and browsing behavior.

● Cookies and Tracking Technologies: Data collected through cookies and similar

tools to enhance your user experience. - How We Use Your Information

We use your information for the following purposes:

● To provide, operate, and improve our Services.

● To process payments and fulfill transactions.

● To communicate with you about updates, promotions, and support.

● To ensure compliance with legal and regulatory requirements. - Data Sharing and Selling

● We do not sell your data: Your personal information will never be sold to third parties

for marketing or other purposes.

● We do not share your data: Your information is not shared with third parties, except

as required to provide our Services (e.g., payment processors) or comply with legal

obligations.

- Data Retention

We retain your information only as long as necessary to fulfill the purposes outlined in this

policy or as required by law. - Your Rights

Depending on your location, you may have the following rights regarding your data:

● The right to access, correct, or delete your information.

● The right to restrict or object to certain data processing activities.

● The right to withdraw consent where applicable.

To exercise these rights, please contact us using the information below. - Data Security

We implement industry-standard security measures to protect your information from

unauthorized access, loss, or misuse. However, no system is entirely foolproof, and we

cannot guarantee absolute security. - Third-Party Links and Services

Our Services may contain links to third-party websites or services. We are not responsible

for the privacy practices of these third parties. - Children’s Privacy

Our Services are not intended for individuals under 18 years old. We do not knowingly

collect personal information from children without appropriate consent.

- Changes to This Policy

We may update this Privacy Policy periodically. Changes will be effective immediately upon

posting, and continued use of our Services constitutes acceptance of the updated policy. - Contact Us

For questions or concerns about this Privacy Policy or your data, please contact us:

Email: info@brownphillips.com

Phone: 919-874-0405

Address: 4940 Windy Hill Dr Ste B, Raleigh, NC 27609

By using our Services, you acknowledge that you have read, understood, and agree to this

Privacy Policy.

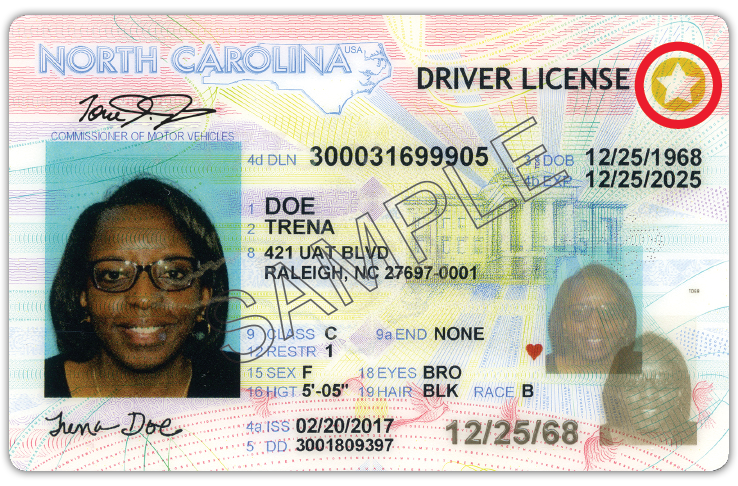

NC REAL ID

As you know, insurance and the DMV go hand-in-hand. Proof of liability insurance is required to do a number of things at the DMV, including obtaining a driver’s license or registering a vehicle. Because what we do is so often tied into the reasons that you go to the DMV, we are trying to get the word out about a new initiative – the NC REAL ID – that you can take care of the next time you visit the DMV.

Beginning in October of 2020, federal agencies will start enforcing tougher security standards at airport check-ins, federal buildings, military installations and nuclear sites. The federal identification standard is changing, and a state-issued driver’s license will no longer be sufficient for those who want to fly, enter a federal building like a courthouse, or visit a military base.

The REAL ID Act was passed by Congress in 2005 in response to recommendations from the 9/11 Commission following the 2001 terrorist attacks. The NC REAL ID is a REAL ID Act-compliant driver’s license that is just like a traditional license or ID but has a gold star at the top. Driver’s licenses and IDs without a gold star are noted “Not for Federal Identification.”

The NC REAL ID is completely optional. You will not need an NC REAL ID driver’s license or identification card to do any of the following:

Drive; Vote; Apply for or receive federal benefits (e.g., Veterans Affairs, Social Security Administration, etc.); Enter a federal facility that does not require an ID (e.g., a post office); Access a hospital or receive life-saving services; Participate in law enforcement proceedings or investigations (e.g., serve on a federal jury, testify in federal court, etc.).

An NC REAL ID, however, will be helpful for anyone who frequently:

Boards a commercial airplane; Visits nuclear sites; Visits military bases; Visits federal courthouses, federal prisons or other federal facilities.

An individual without an NC REAL ID or U.S. passport will still be able to board flights or make visits to the facilities mentioned above, but they will have to provide additional documentation with their traditional license or ID.

The cost of the REAL ID is the same as a normal renewal if obtained within six months of your current license expiration. If you are obtaining the REAL ID outside of the renewal period, the cost is the same as a duplicate ($13). A new photo will be taken, but no tests are required.

Even though the federal law is not effective until Oct. 1, 2020, anyone can get an NC REAL ID now. Simply bring the following documents (no photocopies) to a driver’s license office:

One (1) proof of identity/date of birth: certified birth certificate or unexpired U.S. passport

One (1) proof of full Social Security Number: Social Security card, W-2 or 1099

Two (2) proofs of current physical address: driver license, vehicle registration card, voter registration card, utility bill, cable bill, bank statement

Proof of name change (if applicable): certified marriage license, divorce decree and/or court document indicating the name change (number of documents depend on number of name changes) Additional documents, as well as more information on the initiative, are available at NCREALID.gov

Common Insurance Claim Issues

Each client is different and has different needs for their protection and budget. The worst part of my job is explaining at the time of a claim that you don’t have a coverage for something that is important to you! So please review and ask any questions before a claim arises. After a claim, it is too late to add or adjust coverage for that loss.

Below are some of the most common insurance claim issues.

Auto policy:

- Not having enough liability limits. The state of NC only requires $30,000 per person and $60,000 each accident and $25,000 property damage. These limits can be used up quickly and if you are in a serious claim the other party can sue you personally. You want to make sure you have enough coverage to protect your assets and even consider a personal umbrella policy.

- Not being aware that your deductible applies for a glass claim. If you carry a $500 deductible for comprehensive, most windshields will be less than that. To have full glass coverage you want to have a $0 deductible.

- Not listing all drivers on the policy. A claim can be denied due to an unlisted driver or any other material misrepresentation. It is important to make sure all drivers are listed on your policy.

- Not having optional coverage’s such as medical payments, rental or towing coverage.

Click here for an easy to read and understand explanation of the auto policy and what each coverage means provided by the NC Department of Insurance.

Home policy:

- Not having a flood policy to cover a flood as your home policy excludes floods.

- Not being aware that certain items have limits on the amount of coverage provided and would need to be scheduled to get higher limits. Items such as jewelry, furs, cameras, musical instruments, silverware, fine arts, and golfer’s equipment.

- Not having certain optional endorsements on your policy like water back up or special computer coverage. You can read a list of the most common policy endorsement by clicking here.

- Not having an inventory of your personal belongings in the event of a claim. Having an inventory will ensure you have the proper amount of coverage. Click here for a free app to document and track your items which will be very helpful at the time of a claim.

Click here for an easy to read and understand explanation of the home policy and what each coverage means provided by the NC Department of Insurance.

Click here to visit our agency customer service center to view your insurance policies, your coverage limits, print insurance ID cards, claims and payment phone numbers, update your contact information, download documents, and more.

If you would like to review your policy or make any changes to your coverage, please contact us today.

Hurricane Preparation Tips

Preparing for the storm:

• Designate an out-of-area contact that your family members can call in case you are separated.

• Prepare an emergency kit in a waterproof container or bag. Include your insurance documents, other important documents (e.g. birth certificates and vehicle registrations), phone chargers and prescription bottles. Keep this kit with you.

• If there is time, board up windows and place sandbags around your property.

• Check your home for anything that may fly or be moved by the extremely high winds and either secure it or bring it inside.

• If possible, move any cars, RVs, boats, or other vehicles to a secure area away from weak trees, limbs or areas that could flood.

• Due to potential power outages from downed trees and power surges, stock up on clean water, non-perishable food, extra batteries and emergency backup chargers for mobile devices. If you have infant children, remember to include diapers, baby wipes and formula. Don’t forget to get food for your pets.

• Back up any important computer files and move computers above potential flooding areas of your home or office.

If you’re forced to evacuate:

• Turn off breaker boxes prior to evacuating: This will help prevent electrical surges from destroying your appliances. Also, in the event of water infiltration, it prevents shorts that can lead to fires.

• Never drive through standing water. Underlying currents could carry your vehicle away or trap you in rising floodwater. Find an alternate route. Know your evacuation route and follow the direction of your state and local officials.

After the storm:

• To file a claim, visit our customer service page here to find your policy number and a list of our carriers and their direct claim numbers.

Claims service is available 24/7.

These preparation tips courtesy of National General Insurance.

Dispelling Myths About North Carolina Homeowners Insurance

Courtesy of the Insurance Federation of North Carolina, here are some commonly perceived myths about homeowners insurance in North Carolina, as well as the facts to dispel those myths.

MYTH: North Carolina coastal homeowners pay among the highest insurance rates in the country.

FACT: North Carolina’s average annual coastal homeowners insurance rate is the lowest in coastal states from North Carolina to Texas. [Source: Property Insurance Plans Service Office (PIPSO)]

MYTH: North Carolina homeowners insurance companies are highly profitable.

FACT: Property insurance requires a long-term investment by insurers, with profits needed in most years to offset the inevitable catastrophic losses. Over the last 25 years, North Carolina’s homeowners insurers have experienced a negative cumulative return on net worth (-2.3%). [Source: National Association of Insurance Commissioners (NAIC)]

MYTH: Current “consent to rate” rules don’t adequately protect the consumer.

FACT: Consumers always have the freedom to evaluate their options and select the best combination of coverage, service and price for their individual needs.

Consent to rate is a transparent and necessary byproduct of North Carolina’s unique regulatory system, which has been in effect for over 35 years. Unlike every other state in the country, North Carolina’s rates are set using a process that collectively sets AVERAGE RATES through the Rate Bureau.

Since the Rate Bureau’s average rates ultimately serve as the maximum rate for each consumer, rating flexibility is necessary to ensure market availability and achieve adequate rates for above average risks. State law permits insurance companies to charge higher than average rates for some lines of insurance, provided the consumer consents to the higher rate.

MYTH: North Carolina has a low risk of hurricane damage.

FACT: Since 1960, three of the most hurricane-prone counties in the country are in North Carolina (Carteret, Dare and Hyde). The state has more than $163 billion in insured values along its coast.

In addition to population growth, the average claim severity has increased more than 155% over the past 15 years. [Source: U.S. Census Bureau; AIR Worldwide (AIR) – a respected provider of risk modeling software and consulting services used throughout the country; Fast Track Monitoring System]

MYTH: Catastrophe models are used by insurance companies to justify rate increases.

FACT: Computer simulated models help provide loss predictability by combining historical losses with current demographic, building, scientific and financial data to project future losses for a certain geographic area.

Catastrophe models do not calculate rates. They are simply one component that helps insurers predict and evaluate probable losses for particular concentrations of risks. Adequate rates are essential to sustaining a viable insurance market in North Carolina. [Sources: NAIC, U.S. Census Bureau, AIR]

“WHY HAVE MY INSURANCE BILLS GONE UP?”

UPDATE effective April 1, 2018: The North Carolina Reinsurance Facility surcharge is increasing again from 11.45% to 13.24% due to higher sustained losses in the Reinsurance Facility. Per state law, the surcharge is combined with BI/PD premiums and charged to all policyholders with all companies across the state.

————————————————

“Why have my insurance bills gone up?”

It’s one of the most common questions we get asked when clients receive their renewal offers and see that their premiums have risen despite not having made any changes to their coverage. This can be due to any number of reasons – the easiest of which to comprehend are claims for accidents, or speeding tickets that may have been acquired during the previous year.

However, a common culprit for premium increases that most people don’t know about is something called a “recoupment charge,” which may appear on your policy labeled as “NCRF Clean Risk Allocation.” It can sound complicated but we’ll explain it to you as best we can.

As you probably know, North Carolina requires every driver to carry liability insurance, no matter how high of a risk they may be to insure. Because everyone needs coverage by law, insurance companies are not permitted to turn away high risk drivers who are seeking the required coverage. To prevent any one company from taking on too much risk, in 1973 the North Carolina Reinsurance Facility (NCRF) was created to ensure that all eligible drivers are able to purchase a policy.

The goal of the NCRF is to distribute losses proportionally across all member companies to offset the high-risk policies that some companies may take on. Insurance companies may pass, or cede, certain high risk policies to the NCRF to avoid the potential losses. The amount of state drivers covered by the NCRF can hover around 25 percent, and when many of those drivers prove to be the risks they were thought to be, the NCRF loses money. Because the NCRF typically operates at a deficit each year, the “recoupment charge” was created by the North Carolina Rate Bureau (NCRB) to help balance this out. This charge is added to all North Carolina auto policies with all companies. It increased from 4 percent to 9 percent in October 2016, and was again increased to 11 percent on April 1, 2017.

How is this rate calculated? Again, there a number of factors. One of the main reasons is inflation. The cost to repair vehicles damaged in accidents has increased dramatically, while medical costs have risen for accident injury victims. The population continues to grow in North Carolina, and with more people comes more accidents and claims.

Here are some facts from the NCRB:

-In 2015, the most recent year available, fatalities increased 8.1 percent from 2014, injuries increased 11.8 percent and reported crashes were up 11.1 percent.

-Mileage driven in 2015 was up 13 percent from the average of the preceding five years.

-Inflation in 2016 has increased vehicle repair costs by 2.4 percent and total medical care costs by 3.8 percent.

-The NCDMV estimates that there were 7 percent more crashes in 2015 due to distracted driving and 13.2 percent more alcohol related crashes.

All of these factors are considered when there is a rate increase, and clients will start to see those rate increases reflected in the premiums as renewal dates come around.

Here at Brown-Phillips, we’ll certainly do anything we can to help you offset these increases by finding other ways to reduce your premium. Are you interested in reducing your coverage or raising your deductible? Are you able to pay your premium in full as opposed to installments? Would you like to bundle the policy with a homeowner’s or renter’s policy? Sometimes these things can enact discounts that could help counteract the rising costs.

On the bright side, it’s also key to note that in spite of these changes, North Carolina drivers still enjoy the fourth-lowest auto insurance rates in the entire country. Thanks again for the chance to review and service your insurance needs.

THANK YOU FOR YOUR POSITIVE FEEDBACK

Thanks to you, our valued clients, Brown-Phillips was recently named by Three Best Rated as one of the Top 3 Insurance Agents in Raleigh!

This is all decided by customer reviews, so we are are honored – thank you!

Check it out: https://threebestrated.com/insurance-agents-in-raleigh-nc

SAFETY TIPS FOR HALLOWEEN

Whether your customers are chaperoning little ghouls and goblins around the neighborhood, hosting trick-or-treaters or going to a costume party, we’ve put together some tips to ensure the biggest risk they’ll face is a candy-induced cavity.

Safety tips for trick-or-treating

Don’t let your ghosts be invisible – Ensure your kids are visible while trick-or-treating by creatively decorating their costume and candy bags with reflective tape or stickers. Glow sticks and flashlights (with new batteries) will also make children more visible to drivers.

Hospital visits are horrifying – Be sure to avoid masks that obstruct vision and check that costumes fit correctly. Stick to well-lit streets and never cut through dark yards or alleys. This can prevent serious injuries from trip and falls.

It’s ghastly going alone – Until they reach the age of 12, children should be accompanied by a responsible adult. Even after that, they should not trick-or-treat alone. They should only go to houses with the front-porch lights on. Let them know to never enter a house or car to get a treat.

Plan your haunting beforehand – For children that are old enough to trick-or-treat alone, plan an acceptable route and agree on a time they should return before they leave the house. If possible, they should also carry a cell phone so they can stay connected.

Making your home safe for Halloween

Get your sidewalk neat before they trick-or-treat – Walk the path from the street to your door and clear anything that trick-or-treaters could trip over or slip and injure themselves. This includes gardening equipment, hoses, toys, potted plants, lawn ornaments and even Halloween decorations that block the path to your front door.

Make your yard spooky, not dangerous – Be sure to clean up before candy-fueled children charge through your yard. Remove dead branches, sticks and acorns, rake up the leaves, fill in holes and trim your hedges to prevent any injuries.

A well-lit driveway can still be scary – There’s nothing scarier for a homeowner than seeing a masked trick-or-treater blindly stagger up your dark driveway. Help them out by turning on all of your exterior lights and lining your driveway and sidewalk with lights or luminaries. Never use any open flames, which could lead to disaster and injury. Instead, use LED tea lights or other decorative Halloween lights to prevent a fire. These should also be used in jack-o-lanterns in lieu of candles.

Keep your beasts in the dungeon – It doesn’t matter if you’ve got a vampire bat or a kitten as a pet, a constantly ringing doorbell can be too much excitement for your animal. To keep your pet from sprinting out of your open front door and possibly injuring someone, keep them confined to another room in the house.

Safe driving tips for Halloween

No speed demons allowed – If you are driving through a residential area, drive as slow as possible. Avoid passing stopped vehicles in case they are dropping off children. You should also be especially cautious when entering and exiting driveways.

The horrors of distraction – On Halloween, neighborhoods are filled with children unexpectedly darting out into the street. Put away your cell phone and don’t look away from the road to ensure you don’t injure any trick-or-treaters. You should also never drive while wearing a mask.

Turn signals aren’t terrifying – Communicate your intentions to pedestrians and other drivers by using your turn signals. If you’re dropping off trick-or-treaters, pull over and use your hazard lights.

Drinking on Halloween can be a nightmare – It doesn’t matter if you’re driving or walking, drinking on Halloween can be a deadly choice. The combination of alcohol and the increased number of people walking in the streets at night makes Halloween the most dangerous night of the year for pedestrians.